Business and Other Risks

Risk Management Structure

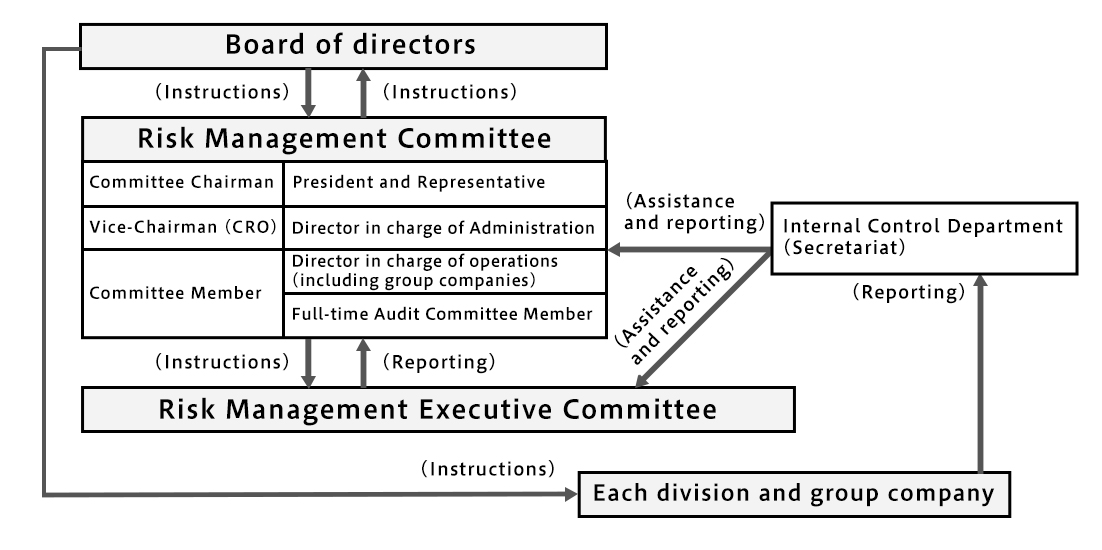

The Group is committed to risk management as a means of strengthening its management structure to be able to respond to risks, which are uncertain factors in management. For the purpose of improving company-wide risk management, the "Risk Management Committee," chaired by the President, has been established as an organization to oversee the Group's risk management activities in accordance with the Risk Management Regulations, etc.

Risk Management Process

The Group's risk management process begins with an annual review of risk items based on changes in the business environment surrounding the Group and social trends, and a risk assessment based on two axes: impact and likelihood of occurrence.

As a result of the risk assessment, risk items with high impact or high likelihood of occurrence are reviewed and discussed by the "Risk Management Committee," consisting of directors and general managers, to determine specific risk prevention measures and ways to minimize the impact of risk when it occurs. The Risk Management Committee then submits proposals to the Risk Management Committee as candidates for the Group's major risks.

The "Risk Management Committee" discusses the proposed critical risk candidates from the management and business continuity perspectives, and prioritizes the critical risks to be addressed and their preventive measures. It also establishes, revises, or repeals regulations concerning risk management, submits proposals to the Board of Directors concerning the promotion system of risk management, and reports to the Board of Directors on risk management activities for risks including material risks.

The Board of Directors shall deliberate on the establishment, amendment, or abolishment of regulations concerning risk management and the promotion system of risk management, and when necessary, give instructions to the "Risk Management Committee" and other committees to deal with such matters.

The progress of risk management activities for risk items, including major risks, are reported from each division and group company to the "Risk Management Executive Committee" and "Risk Management Committee" through the secretariat, and are further reported to the Board of Directors.

Major Risks of the Group

The following are major risks that may have an adverse effect on the financial position and operating results of our group among the matters related to business conditions, accounting conditions, etc., stated in the Annual Securities Report, and we consider these to be matters that may have a significant impact on the decisions of investors.

Forward-looking statements in this text are based on the judgment of our group as of the end of the current fiscal year, but are not limited to the items listed here.

(1) Risk of not meeting consumer needs

In order to meet consumer needs, the Group develops attractive new brands and products, cultivates new brands and products through marketing activities, and strengthens existing brands and products. The Group's ability to meet consumer needs has a significant impact on its sales and profits. In addition, the Group continues to withdraw existing brands and products that no longer meet consumer needs. However, because such activities are by their nature subject to uncertainty due to a variety of factors, failure to achieve the initially intended results could have a negative impact on the Group's financial position and operating results.

(2) Risk of dependence on specific brands and products

Based on a brand development system that integrates the four axes of "Creation," "Technology," "Branding," and "Marketing," the Group continuously creates new brands and new products, aiming to develop business without being biased toward specific brands and products such as ReFa and SIXPAD. However, business activities to increase the number of product pillars are still underway. However, business activities to increase product pillars, by their nature, are subject to uncertainty due to various factors, and if initially intended results are not achieved, the Group's financial position and operating results may be adversely affected.

As a countermeasure, the Group is striving to stabilize its operations by expanding its business models, such as B-to-B business and subscriber business, in conjunction with business activities to increase its product pillars.

(3) Risk of dependence on a specific person

Since the Company's inception, the founder of the Company, Tsuyoshi Matsushita, has served as President and Representative Director of the Company. Mr. Matsushita plays an important role in the promotion of the Company's overall business and brand building. If for some reason it becomes difficult for Takeshi Matsushita, the President and Representative Director, to continue his duties, the financial position and business performance of our group may be adversely affected.

As a countermeasure, the Group strives to recruit excellent human resources, divide the organization into profitable divisions (PC = profit center), adopt a management system that operates based on a divisional profitability system, and develop human resources with managerial awareness as PC leaders and train their successors. In addition, we are striving to build an organized business management system that does not depend on the generosity of any one individual.

(4) Risks related to supply chain

The Group considers its supply chain partners to be partners with whom it shares a common bond of prosperity and receives parts and products from outside companies located in Japan and overseas. However, in the event of natural disasters, accidents, geopolitical issues, political instability (war, civil war, conflict, riot, terrorism, etc.), unforeseen changes in laws and regulations, or bankruptcy of the partner for any reason in the region where the partner is located, the supply of parts and products may be affected, This may affect the financial position and business performance of the Group. In addition, if the supply-demand situation in the market or the raw material prices of parts and materials purchased from such partners rise sharply, we may not be able to secure parts and materials at reasonable prices.

As a countermeasure, we are striving to identify foreseeable risks through collaboration and communication, such as by holding "Partner Cooperation Meetings" on a regular basis. In addition, for the supply of parts and products, from the viewpoint of risk diversification, we are promoting multi-company purchasing, rather than relying on a certain country of production or a single partner.

(5) Risks posed by quality problems (product safety)

However, in the event of a large-scale recall due to unintended product defects, or in the event of product defects that could lead to product liability claims, such as health hazards, for products sold, the Group's financial position and operating results could be adversely affected. This could have a negative impact on the financial position and business performance of the Group.

As a countermeasure, the Group is strengthening cooperation with its manufacturing partners and building a system to ensure performance from the early stages of development, as well as conducting on-site quality audits in terms of securing the manufacturing process. In addition, the Group has introduced a review board system in which advisors with expertise in quality and development participate in new product development.

In addition, the Group is expanding its business domain into food products such as drinks that are consumed by customers. In terms of food safety, the Group has established a process control system by collecting industry information, sharing important information with experts in the field, and conducting on-site quality checks.

(6) Foreign exchange risk

Based on the policy that the Company bears the foreign exchange risk in intergroup transactions, the Company consolidates the effects of foreign exchange fluctuations in foreign currency transactions and manages the exchange rate fluctuations at the Company. However, rapid fluctuations in exchange rates could have a negative impact on the financial position and business performance of the Group.

As a countermeasure, we strive to reduce foreign exchange risk by entering into forward exchange contracts as appropriate, in accordance with our foreign exchange control policy.

(7) Risks related to intellectual property rights

With patents being filed daily in countries around the world, our Group is at risk of unintentional infringement of patents and design rights of third parties , which could result in claims for substantial damages both in and out of court.

As a countermeasure, the Group has strengthened its Intellectual Property Department, which manages patents and other intellectual property rights, to ensure that new technologies developed by the Group are protected by the Group, and to conduct preliminary investigations to prevent conflicts with patents, design rights, and other intellectual property rights of third parties when developing and marketing products. In addition, when developing and marketing products, we take all possible precautions to prevent infringement of third-party intellectual property rights, such as conducting preliminary investigations to ensure that there are no conflicts with patents, design rights, or other intellectual property rights of third parties, and taking measures to avoid such conflicts if they are foreseeable.

In addition, the Group strives to establish a solid brand value by preventing competitors and imitators from developing similar products. However, the Group's business performance could be adversely affected by the unforeseeable movements of competitors and other parties.

As a countermeasure against counterfeit products, the Group is working to acquire patent rights and other intellectual property rights ahead of time, taking into account the development of counterfeiters. In addition, the Group monitors and analyzes information on the market and sales, etc., to grasp the occurrence of counterfeit products at an early stage, and conducts activities to reduce the chances of consumers mistakenly purchasing counterfeit products by continuously informing and alerting consumers of the risks of purchasing counterfeit products.

(8) Risks related to human resources

The Group is committed to securing and developing excellent human resources as the driving force behind its business. However, with Japan's working population on the decline, if we are unable to hire human resources as planned, or if we are unable to proceed with the systematic development of internal human resources, our competitiveness may decline and business expansion may be hindered, which may adversely affect the financial position and business performance of our group.

As a countermeasure, the Group is striving to create a company and workplace that is rewarding to work for, to create an environment in which employees can settle in and play an active role after joining the company, and to obtain and improve engagement scores. In terms of human resource recruitment, the Group is actively recruiting through collaboration between the human resources department, departments with hiring needs, and outside specialists. In terms of human resource development, in addition to various training programs, we have introduced a group management system to encourage the development of management awareness. Specifically, we divide the organization into profitable divisions and develop human resources with a management awareness through business management based on divisional profitability.

(9) Risks related to information security

The Group takes security measures to protect information assets such as personal information, customer information, and confidential business information. However, in the event of information leaks or other incidents due to unauthorized access that cannot be anticipated, the Group's financial position and business performance could be adversely affected.

As a countermeasure, the Group is strengthening information security measures centered on infrastructure as well as information infrastructure, and enhancing IT literacy through employee education such as introductory training for new employees and security training conducted once a year. Furthermore, we have acquired the Privacy Mark (JIS standard) certification, which certifies that a company is appropriately protecting personal information.

(10) Risks related to compliance

The Group handles a wide variety of products in Japan and overseas and is therefore subject to a wide range of related laws and regulations. Specifically, there are the Companies Act, Financial Instruments and Exchange Act, tax laws, various business laws, anti-monopoly laws, intellectual property laws, subcontract laws, Act against Unjustifiable Premiums and Misleading Representations, Pharmaceutical Affairs Act, Basic Consumer Law, e-commerce related laws, specified commercial transaction laws, and other laws and regulations in the relevant countries related to overseas business. The Group recognizes that compliance with laws and regulations is an extremely important corporate responsibility and is working to ensure thorough compliance with laws and regulations. However, even with these measures, we cannot avoid risks related to compliance, including personal misconduct, as well as the risk of damage to social credibility and brand value. In the event that such risks materialize, the Group's financial position and operating results may be adversely affected.

As a countermeasure, the Group has established a Compliance Committee, which promotes various compliance activities (training, surveys, etc.) and reports regularly to the Board of Directors. We have also established an internal reporting system to detect and correct violations of laws and regulations, internal rules, and harassment at an early stage, thereby strengthening compliance.

(11) Risks related to natural disasters

In the event of an earthquake or other natural disaster in the area where the Group's logistics bases or external partners are located, product shipments or supply of parts and products may be affected, which may adversely affect the financial position and business performance of the Group.

As a countermeasure against the impact on product shipments due to a disaster at a logistics base, the Group has secured two shipping locations, and will further diversify its logistics bases in the future.

As a countermeasure against the supply of parts and products being affected by a disaster at an external partner, the Group will promote purchasing from multiple suppliers rather than relying on a certain country of production or a single partner, while building trust with partners by visiting them regularly during normal times to establish a relationship that allows mutual cooperation in an emergency situation. We will also work to build a relationship with our partners that allows us to collaborate with them in the event of an emergency.